Summary

- The current stock market is still expensive by historical standards, but deals do occasionally appear.

- AmerisourceBergen's earnings have mostly been unaffected by COVID-19 and continue to grow at a steady rate.

- If the stock reverts to its historical mean over the next several years, it will provide very good returns for investors.

- I do much more than just articles at The Cyclical Investor’s Club: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Introduction

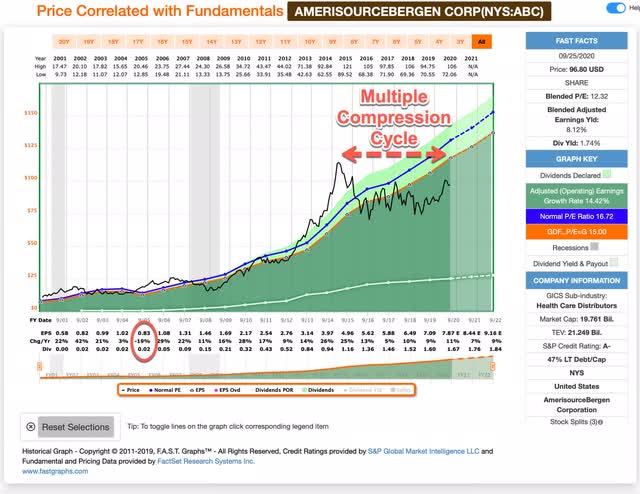

In mid-2015, AmerisourceBergen's (ABC) stock price peaked around $115 and it has traded below that price ever since, even though earnings grew about 9% consistently every year for the past 5 years. The market hasn't given the stock any credit for this growth even though it is likely to continue for the next several years. After recently reviewing and updating over 270 non-cyclical stocks for the Cyclical Investor's Club and reflecting about the macro backdrop we are now operating in, I found some stocks I had been more bullish on which I have now become more bearish about, and some I had been more bearish on I have become more bullish. My last two articles were about stocks I recently sold (Bank of New York Mellon (BK) and Sysco Corporation (SYY)). This article will be about a stock in which my sentiment changed in the other direction and I bought: AmerisourceBergen.

I have written about AmerisourceBergen one time previously in early 2019. It was one of my first public articles where I used what I call a "Full-Cycle Analysis", though I mostly chose to ignore the results of the analysis at the time because I questioned whether ABC could continue to grow earnings at 10% per year with GDP likely growing far less than that over the next decade, and I suggested a recession buy price for ABC of $61 in that article. Several months later when I reviewed ABC again in the Cyclical Investor's Club, I was more generous and I changed the recession buy price to $72.00. During the March sell-off, the stock bottomed at $72.06, so, while my updated estimate was close, it didn't trigger a sale and I missed buying near the bottom of the recession for this stock.

Since March, we have had both a dramatic intervention by the Federal Reserve and lots of fiscal stimulus by the federal government. This intervention was enough to hold off a deeper recession. Currently, the economy needs more federal stimulus if we are to avoid an extended recession. While I don't expect that stimulus to come before the November elections, I do expect that it will eventually come by February of next year, and I expect that it will be big enough to prop up the economy until COVID-19 subsides in mid-2021. So, my outlook over the next 4 months at the macro level is very choppy, but after that, I think the government will do what is necessary to save the economy from an extended recession.

That macro backdrop is important when it comes to explaining why I'm buying ABC now, instead of buying it a few months ago when it was cheaper. All the way back in 2019 through today, I was expecting a recession to occur, and so I was aiming for recession prices. Now that we are mid-recession, the stock price missed my buy price, and stimulus is coming from the government, I think we need to start looking beyond the recession. In addition to that, with more money being pumped into the economy and the world focused on COVID-19, I think it's more likely that ABC can continue their 9-10% earnings growth trend into the near future. So, both of those factors came into play in changing my mind about the stock.

With that background established, let's run through the Full-Cycle Analysis of AmerisourceBergen and see what sort of returns I estimate.

Earnings Cyclicality

The first thing I try to determine when I examine a stock is how cyclical their earnings have historically been. If earnings have been highly cyclical, which I roughly define as having dropped more than -50% off their highs, then I classify the stock as "cyclical" and I have a specialized type of analysis that I use for these stocks instead of a traditional analysis that examines earnings and earnings growth rates. In ABC's case, they only have a single year of earnings declines way back in 2005 in which EPS fell -19% that year. All of the other years for the past two decades EPS has grown. So ABC is not what I consider a highly cyclical stock and I can proceed with a Full-Cycle Analysis.

The first thing I try to determine when I examine a stock is how cyclical their earnings have historically been. If earnings have been highly cyclical, which I roughly define as having dropped more than -50% off their highs, then I classify the stock as "cyclical" and I have a specialized type of analysis that I use for these stocks instead of a traditional analysis that examines earnings and earnings growth rates. In ABC's case, they only have a single year of earnings declines way back in 2005 in which EPS fell -19% that year. All of the other years for the past two decades EPS has grown. So ABC is not what I consider a highly cyclical stock and I can proceed with a Full-Cycle Analysis.