Summary

- The substantial reserve built for loan losses in the second quarter is likely to cover pandemic-driven impairments in the year ahead. Therefore, provision expense is likely to decline.

- Margin will likely continue to decline due to repricing and maturities of assets. Further, excess liquidity following the sale of BlackRock will hurt margin.

- Target price for June 2021 suggests a high upside from the current market price, which justifies a bullish rating.

The PNC Financial Services Group, Inc. (NYSE:PNC) reported a loss of $1.90 per share from continuing operations in the second quarter as opposed to earnings of $1.95 per share in the first quarter of the year. The loss was mostly attributable to hefty provisions for credit losses during the quarter. Although earnings are unlikely to return to pre-COVID-19 levels this year, an improvement from the first half of the year is probable. The allowance for credit losses built during the second quarter will likely cover pandemic-driven loan impairments in the year ahead. Consequently, PNC will likely book much lower provision expense in the second half of the year compared to the first half. On the other hand, a continued decline in net interest margin will likely limit the earnings recovery. For the full year, I’m expecting PNC to book earnings of $4.40 per share from continuing operations (i.e. excluding BlackRock), down 61% from last year. The current stock price is at a large discount to the one-year ahead target price, which shows that the market hasn’t yet fully priced-in the likelihood of earnings improvement. Based on the price upside, I’m adopting a bullish rating on PNC.

High Reserve Built in the Second Quarter to Cover Loan Impairments in the Second Half of 2020

PNC reported a provision expense of $2.5 million in the second quarter of 2020, up from $0.2 million in the corresponding period last year. The large amount of provisioning was based on a distressed economic outlook, the details of which are given in the second quarter’s conference call. In the base economic scenario, the management assumed GDP contraction of 6.2% in the third quarter and 4.9% in the fourth quarter on a year-over-year basis. Further, the management assumed GDP to return to pre-recession peak levels by the first quarter of 2022. Moreover, the management assumed an unemployment rate of 9.5% for the fourth quarter of this year and a recovery period that extends to 2022. The management’s macroeconomic assumptions appear reasonable in the current economic environment; therefore, I’m expecting the reserves built in the second quarter to be mostly sufficient for upcoming loan impairments in the year ahead.

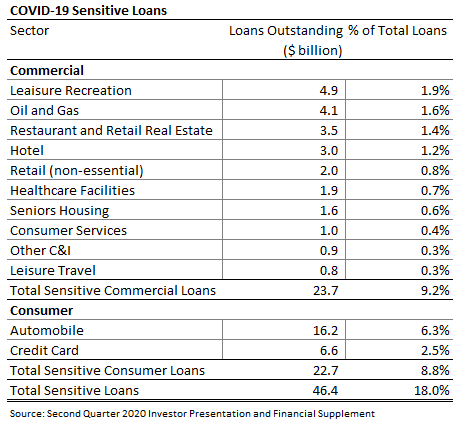

However, PNC has some exposure to COVID-19-sensitive loan segments that will keep credit risks elevated. According to details given in the second quarter’s investor presentation and financial supplement, COVID-19-sensitive commercial loans made up 9.2% of total loans, and sensitive consumer loans made up 8.8% of total loans as of June 30, 2020. The table below shows the exposure to vulnerable loan segments. Within the consumer segment, PNC provided payment relief to loans amounting to $12.7 billion, or 5% of total loans, as mentioned in the presentation. The payment relief shows the extent of debt servicing problems in the consumer portfolio. As mentioned in the presentation, the management expected net loan charge-offs of $250 to $350 million in the third quarter. Considering the factors mentioned above and management’s guidance on charge-offs, I’m expecting PNC to report a full-year provision expense of $4.2 billion, up from $0.8 billion in 2019.

Excess Liquidity, Economic Downturn to Hurt Net Interest Income

PNC’s net interest margin, NIM, declined by 14bps in the second quarter following the 150bps federal funds rate cuts in March. The repricing and maturity of earning assets will likely decrease the NIM further in the second half of the year. Moreover, PNC has excess cash following the sale of BlackRock in May 2020 that led to proceeds of $14.2 billion, as mentioned in the second quarter’s earnings release. As mentioned in the conference call, the management expected to have a high cash balance until the end of the year. It will take time to deploy the excess liquidity into higher-yielding assets; therefore, the average NIM will likely remain under pressure from the extra cash. Consequently, I’m expecting NIM to decline by 34bps in 2020, as shown below.