Summary

- Spun-off from BGC Partners, Inc., Newmark offers real estate services mainly in the United States.

- With recurrent sales and trading at 5x 2020 Adjusted EBITDA, Newmark represents, in our opinion, a good buying opportunity.

- In our view, the company is expecting substantial revenue synergies across the company’s platforms from the acquisitions executed.

- The fact that Cantor Fitzgerald, L.P. controls the company may not be appreciated.

Newmark Group (NMRK) is trading at less EV/EBITDA ratio than its peers with more EBITDA margin. In our view, investors did not have to study the company’s most recent acquisitions and the expected synergies. The company is a controlled entity, which we don’t appreciate. However, we don’t think that the current EV/EBITDA ratio of 5x can be justified at all.

Impressive Business Growth Through Acquisitions

Spun-off from BGC Partners, Inc. (NASDAQ:BGCP), Newmark offers real estate services mainly in the United States.

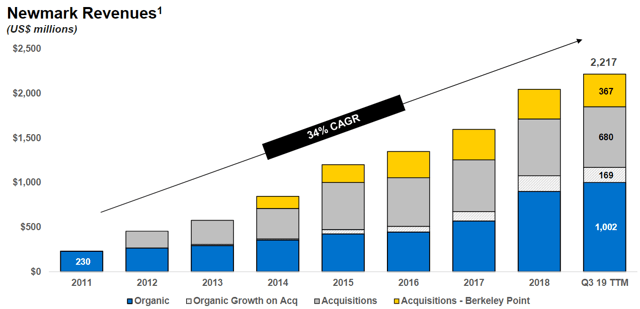

The company is growing at a massive pace through the acquisition of other competitors all over the country. We believe that the growing goodwill and potential synergies will interest the financial community. Notice that the company’s sales compound annual growth rate was equal to 34% from 2011 to Q3 2019. As shown in the image below, in Q1, Q2, and Q3 2019, the acquisitions represented 83% of the total amount of sales:

Source: IR Presentation

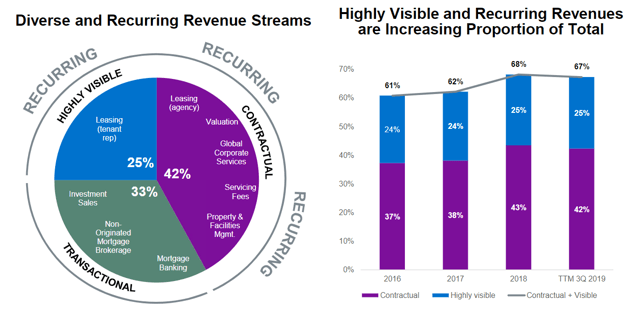

It is also quite convenient for shareholders to know about Newmark’s recurring revenue. In the 9M ended September 30, 2019, 42% of the total amount of sales came from contractual obligations. Besides, 25% of the total amount of sales appear to be highly visible. Financial investors and bankers appreciate businesses in which sales can be easily predicted like that of Newmark. Note that financial models can be more easily prepared when sales and cash flow are not that volatile, like in this case:

Source: IR Presentation

Besides, the company’s revenue is well diversified. Newmark has acquired a significant amount of businesses in the past, which brought many different business models. Among the different products offered, Newmark offers investment sales and access to providers of capital, asset sales, mortgage and entity-level financing, and due diligence. Also, the company offers agency leasing, and more than 400 professionals offer national valuation and advisory business as well as property management.