Summary

- Falling earnings and a contracting valuation multiple have proved a toxic combination for Kraft Heinz stock over the past few years.

- The scruffy-looking cash flow statements have led to legitimate concerns that management will cut the distribution again.

- In reality, underlying cash generation is not as bad as the headline figures suggest.

- That said, if management felt compelled to accelerate debt reduction plans and invest in the company's brands, then I'd be more than happy for a cut.

- The stock has become a sufficiently low expectation investment that it doesn't need to deliver much beyond stabilizing profits and reducing debt.

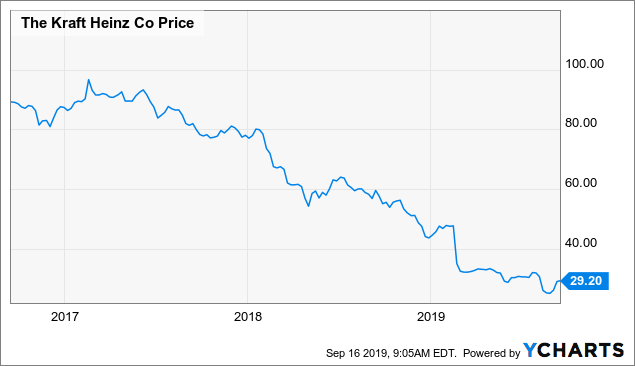

To say that Kraft Heinz (NASDAQ:KHC) has been a disaster zone for investors is probably an understatement. Ultimately, two things have gone very horribly wrong here over the past few years.

First, its underlying business has clearly come under severe pressure. Adjusted EBITDA figures for 2016, 2017, and 2018 read as follows: $7.724B, $7.810B, and $7.014B, respectively. Before 2019 guidance was pulled, management had 2019 EBITDA clocking in at $6.3B at the low end. Needless to say, that's not a particularly encouraging trend.

Second, the stock's valuation as it entered this rough patch was clearly ridiculous. At its peak in 2017, it traded in the low-$90 per share range - equivalent to a P/E ratio of 26.5 and an EV/EBITDA multiple of 18.4.

Data by YCharts

Data by YChartsGiven the drop in EBITDA, it is hardly surprising that the valuation then followed suit; the upshot proving an ugly double whammy for a stock price, which is now down around 70% on that 2017 peak.