Summary

- WTR’s rally has slowed thanks in part to a substantial drop in ETF purchases.

- The stock is flat since our last update, but a risk-on rally could lead some funds to trim their holdings.

- A much bigger threat to their place in passive funds could come from a resurgent healthcare sector.

Just one month out and our recent article, Aqua America And Utility ETFs: Setting Up For A Downpour, is starting to look eerily prophetic as utilities have begun to stumble against the broader market. And while patting yourself on the back is fun, it’s hardly informative for investors who are wondering whether to stick with a formerly strong performer when the fundamental and technical pictures are hardly screaming “sell.”

Plus, we have to think that the strong resurgence by the market, and especially tech stocks, has more to do with flagging interest in utilities rather than anything we’ve written, notwithstanding the latest bump as the DOJ is reportedly contemplating anti-trust proceedings against many of the largest tech names including most of the FAANGs. Now with Aqua America (WTR) and other utilities relatively flat and the bull market on anything but steady legs, should investors stick with WTR or is it time to cash out and run? To answer that question, you must remember that passive ETFs were responsible for helping sustain the recent run-up in utilities, making companies like Aqua America anything but masters of their own fates.

A Steady Drip of “Blah”

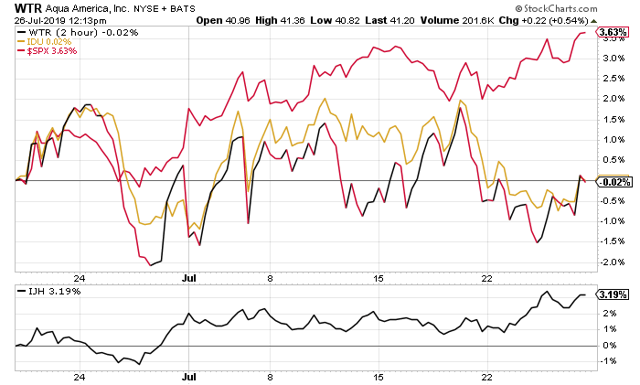

Since our last update, WTR has seen a significant loss of momentum, with its share price losing ground over the last few weeks, and significantly underperforming the broader market, although a recent uptick has left its price relatively unchanged. That might be good enough for a sideways trending market like that of February through April, but with the S&P 500 now up 3.6% since June 19th, it’s no wonder that investors are thinking taking our advice and shifting their attention, and capital, elsewhere.

A thoughtful critic would take the joy out of our victory lap by pointing out the obvious, namely that everything about WTR was elevated when we wrote that article and not just the stock price. WTR’s strong performance in the first half of the year had already pushed its price up over 20%, but also pushed its fundamentals well into nosebleed territory with a trailing P/E of just under 50x along with very low cash reserves and relatively high debt levels.

Nor is that the only red flag at the time of our last article as even a casual technician would look at that chart of WTR we used and point out that the stock was clearly in a “rising wedge” pattern which is invariably a bearish signal which was confirmed just a few days later as the stock flatlined, falling out of its uptrend as it lost all momentum. That shouldn’t come as a surprise to investors as the RSI was trading well within to overbought levels while the Chaikin Money Flow (CMF) score had been falling during the “spring of love” for utilities stocks.