Summary

- While searching for dividend growth plays within the utility sector, I found an unexpected gem.

- At first glance, the company seems too good to be true.

- This 5.5%-yielding dividend growth stock is by far the best choice for new investment in this sector.

- This idea was discussed in more depth with members of my private investing community, The Technical Investor . Start your free trial today »

I've been focusing on the utility sector (XLU) as one of my top three for dividend growth investment this quarter. Aside from having a positive outlook for earnings growth this year and next, the utility sector has several characteristics that make it attractive for new investment. In this article, I will highlight a stock that turned up unexpectedly that I think is a screaming buy.

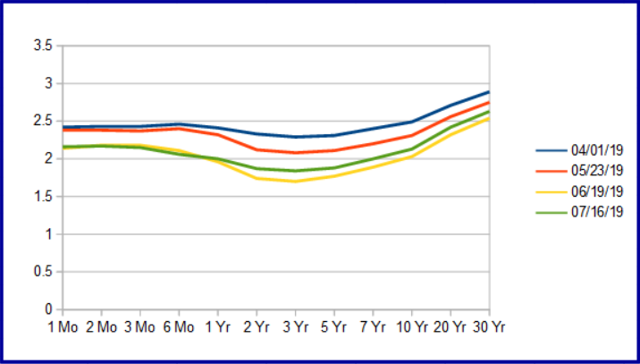

First and foremost, the utility sector is part and parcel to the real assets universe. Real assets offer stable, long-term revenue streams and higher rates of return than traditional equities. With earnings growth in question and uncertainty plaguing the market, I expect real assets and the utility sector will come into sharper focus among investors. The average dividend distribution is yielding well over 3.0%, which is a far cry above the 2.0% offered by the 10-year Treasury.

Treasury Yield Curve: own work

The best part about looking for dividend growth in the utility sector is, virtually, all companies have a history of it. This search is more about picking the best-positioned dividend grower than it is about finding dividend growth. During my search for dividend growth stocks, DTE Energy Company (DTE) came up as a candidate.

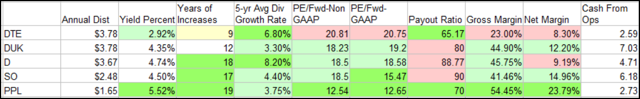

DTE Energy Company ranked well in my basic criteria; years of increase, payout ratio, distribution growth rate, and yield, and is a generally good choice for dividend-growth investors. The problem is that, when I matched DTE up against the top-yielding stocks in the sector, it clearly isn't the best choice. Far from it.

PPL Is By Far The Best Choice For Yield And Value

PPL Corporation (NYSE:PPL), at least from my comparisons, looks like it is by far the best choice among the top-yielding utility stocks. In fact, it looks so good it is almost too good to be true. The stock is yielding better than 5.50% with a relatively safe 70% payout ratio and super-low valuation. The other top-four paying stocks in the sector trade at much higher multiples and yield an average of 4.5% with a near 90% payout ratio.

Source: own work

The part that makes PPL look too good to be true is the valuation. The company is trading at a cool 12.5 times forward earnings, while most others in the group are closer to 18 times earnings. Nothing in the company's history suggests to me why it trades at such a low multiple relative to its peers, but it does.

Source: Seeking Alpha