Summary

- Kraft Heinz has declined rapidly after dismal Q4 2018 earnings.

- Changing consumer preferences and an SEC-issued subpoena have further added to Kraft Heinz's sell-off.

- The fundamentals of the global economy and the strategic restructuring of Kraft Heinz have catapulted the company into a prime position for sustainable future long-term growth.

Overview

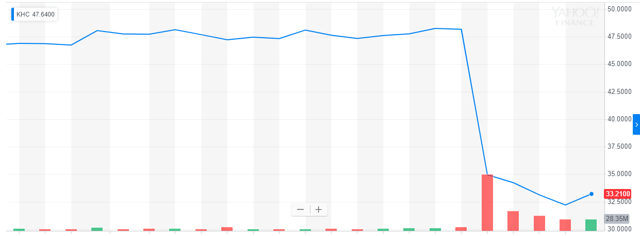

Kraft Heinz (NASDAQ:KHC) has been hit hard this past week. Literally overnight, the company lost $16 billion in market capitalization value after experiencing its largest ever one-day sell-off. Shares of Kraft Heinz dived 27% to a 52-week low of $31.82 as investors rushed to sell their position in reaction to the company’s dismal fourth-quarter results.

Source: Yahoo Finance

To summarize Kraft Heinz’s results:

- $12.61 billion quarterly loss. (About $10.34 per share).

- $0.84 EPS. (Down from Avg. Analyst Estimate: $0.94 EPS).

- Increase in revenue from $6.84 bn to $6.89 bn. (Down from Avg. Analyst Estimate: $6.94 bn).

- Decrease in dividend to $0.40 quarterly per share from $0.625 quarterly per share.