Summary

- The Kraft Heinz company dropped a trifecta of disappointing results, dividend cut and a large writedown on suffering shareholders.

- The stock appears cheap, but part of the problem is bloated forward estimates.

- The other problem is the higher than average leverage.

- We find other more attractive opportunities for now but will issue an alert when we think the dust has settled.

- Looking for a portfolio of ideas like this one? Members of The Wheel of FORTUNE get exclusive access to our model portfolio. Start your free trial today »

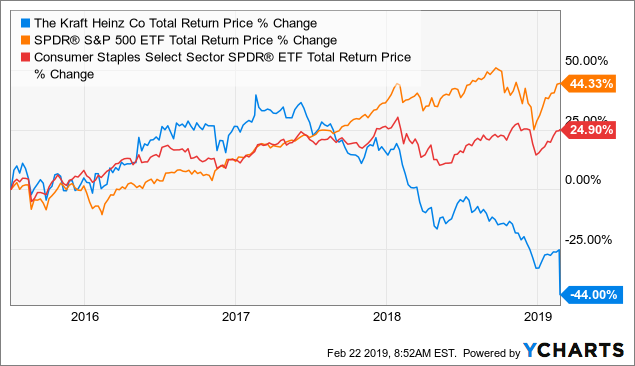

The Kraft Heinz Company (KHC) has been the bane of investor portfolios. After massively underperforming the major indices for the last five years, KHC decided that it wanted to give just one more extra blow to the dividend chasers.

Data by YCharts

Data by YChartsThe Board of Directors of The Kraft Heinz Company today declared a regular quarterly dividend of $0.40 per share of common stock payable on March 22, 2019, to stockholders of record as of March 8, 2019. This represents a reduction of $0.225 from the company's previous quarterly dividend of $0.625.

"We believe this action will help us accelerate our deleveraging plan, provide us strategic advantage through a stronger balance sheet, support commercial investments and set a payout level that can both grow over time and accommodate additional divestitures. By doing this we can improve our growth and returns over time," said Kraft Heinz CEO Bernardo Hees.