For those following the consumer packaged goods industry or Warren Buffett's investments, Kraft Heinz's (NASDAQ:KHC) recent earnings release, which included a massive writedown and dividend cut, provided a stark warning: No longer can investors depend on household-name consumer brands for steady growth and profits, even those run by excellent management. And if a company has used lots of debt to grow by acquisition and pay dividends, look out.

The problem for many big-name food and clothing brands is the recent dual-pronged competition from upstart niche brands with healthier products, and from cheaper private-label options from leading retailers.

After Kraft Heinz's fall, here are three stocks with similar characteristics investors would do well to avoid.

AVOID THESE BIG BRAND CONSUMER STOCKS. IMAGE SOURCE: GETTY IMAGES.

General Mills

Like Kraft Heinz, General Mills (NYSE:GIS) is stuck with a portfolio of legacy brands that may be losing relevance. These include Cheerios, Betty Crocker, Green Giant, Yoplait yogurt, and Progresso soups. Though they're giants of yesteryear, many processed foods, cereals, and sugar-based products now find themselves in a bad strategic position.

Consider General Mills' latest results. "Organic" growth (not organic food, but growth ex-acquisitions) was negative-1% -- and that was after the impact of a 2% price increase in the quarter, meaning organic volume was down by an even greater 3%.

How has General Mills attempted to cope? By making expensive acquisitions. These include the $8 billion acquisition of Blue Buffalo pet food last February, and the $820 million acquisition of organic-food specialist Annie's back in 2014.

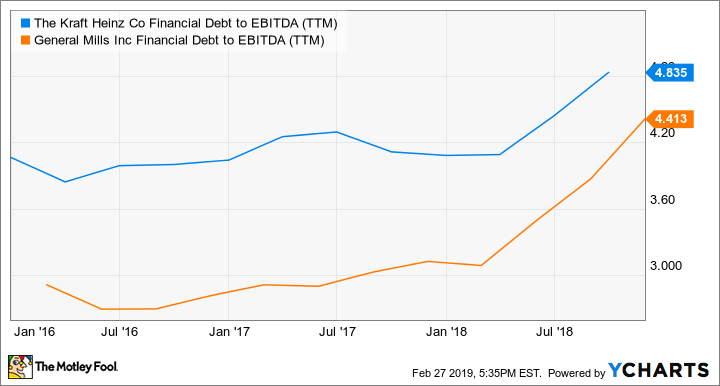

Those acquisitions may be the correct strategic moves, but they have also helped balloon the company's debt to nearly $15 billion, and its debt-to-EBITDA ratio to 4.4.

GIS NET TOTAL LONG TERM DEBT (QUARTERLY) DATA BY YCHARTS

That's almost as high as Kraft Heinz's ratios were before its writedown.

KHC FINANCIAL DEBT TO EBITDA (TTM) DATA BY YCHARTS

Kellogg

Like General Mills, Kellogg (NYSE:K) has many brands centered on carbs and cereal, such as Kellogg's cereals, Pringles potato chips, Pop-Tarts, and Cheez-It crackers.

The concerns around Kellogg are similar to those for General Mills. In its recent quarter, organic sales declined by 0.6%, about a third of that from lower volume, and two-thirds from a decreasein price/mix. So even with lower prices, Kellogg still couldn't generate organic volume growth.

At least full-year results looked a little better, with flat organic sales. However, organic sales had been negative each of the past four years. From that perspective, Kellogg's organic sales are still well below where they were just five years ago.

Also like General Mills, Kellogg has made a series of acquisitions to get into healthier segments and international markets. The most recent were the $600 million acquisition of RXBAR in 2017 and the $420 million stake in Africa's Tolaram Group last year.

While it's possible these acquisitions could help offset declines in its core segments, they've also played a role in Kellogg's debt ballooning to over $8.5 billion, and its debt-to-EBITDA ratio to 4.2, up from the low threes.

These characteristics make Kellogg look a lot like General Mills... and Kraft Heinz.

L Brands

L Brands (NYSE:LB) owns Victoria's Secret lingerie and retailer Bath & Body Works. Although it's not a consumer packaged-foods company, it's still suffering from many of the same headwinds -- lower-cost private labels from big retailers such as Target's Auden brand, as well as millennial-focused upstarts such as ThirdLove.

Like Kellogg and General Mills, L Brands may also be stuck on the wrong side of history. Online upstarts and private labels are trending toward body-positive images and models, whereas Victoria's Secret is known for its high-fashion shows featuring supermodels, which seems out of step today. Just as food consumers are moving away from sugary and processed foods, the move toward more authentic and realistic brands seems to be where the apparel consumer is headed.

In its recent quarter, Victoria's Secret's same-store sales fell 3% overall and 7% in stores. While Bath & Body Works is growing, Victoria's Secret still makes up a majority of sales. So if it's on the decline, a turnaround will be difficult.

L brands cut its dividend in late 2018, as it now apparently realizes it needs to make a dent in its $5.5 billion debt load. Just recently, L Brands stock declined after the recent earnings report, in which the company guided for 2019 earnings per share of $2.20 to $2.90, from $2.82 in adjusted EPS in 2018.

Unfavorable long-term prospects

Though some value investors may like name brands with cheap valuations, remember one of Warren Buffett's four criteria for investments: to find businesses with "favorable long-term prospects." As Kraft Heinz has shown, it will be hard for even the best management teams to overcome these big-brand headwinds, and large amounts of debt will complicate things even further.